Home insurance is a must for anyone who owns a house in the United States. Yet, many homeowners notice that their insurance costs do not match what friends or family in other regions pay. There are several reasons why insurance rates vary significantly across the country. Some factors are apparent, such as weather, while others are more subtle, like changes in local laws. Understanding why these differences exist can help homeowners make better choices about their insurance. It is also essential to know which parts of the country have the highest rates of crime. With the correct information, people can find ways to save and protect their homes.

Understanding Home Insurance Rate Differences in America

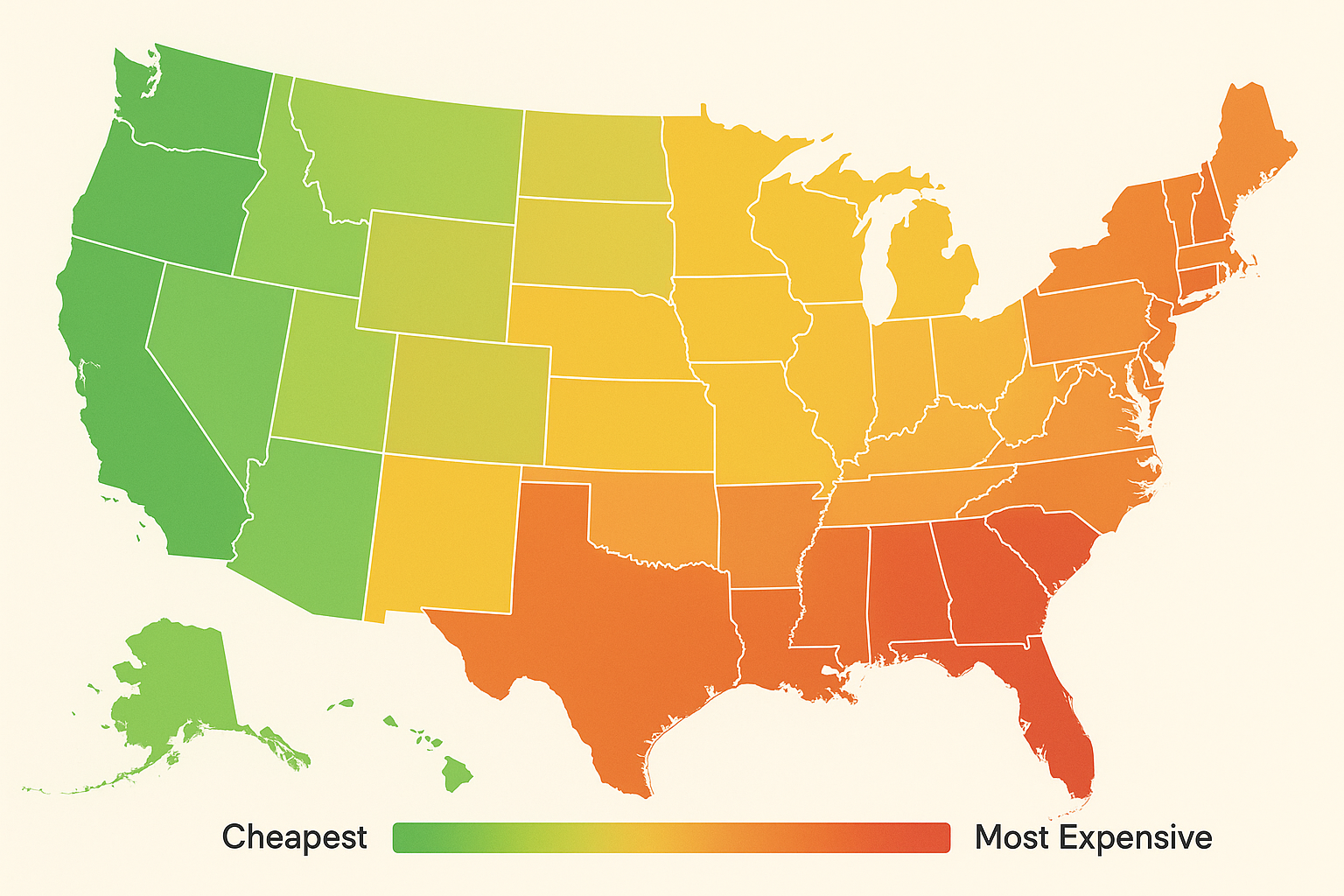

Home insurance rates vary from state to state and city to city in America. The cost often depends on the location of the home and the associated risks. Insurers consider a range of factors unique to each region when setting a price for homeowners. For example, a house in a city known for wildfires may have higher rates than one in an area with fewer natural disasters. Even within the same state, rates can vary significantly from one city to another, depending on local risks.

Local laws and building codes also play a significant role in determining the amount homeowners pay for insurance. Some areas may require stricter building standards to keep houses safer from storms or earthquakes. When homes are built to stronger codes, insurance costs may be lower, as the risk of a significant claim decreases. On the other hand, places with outdated building rules may see higher rates because insurers expect more damage during disasters. The way local governments handle claims and lawsuits also affects the final price.

Population density and crime rates are additional factors contributing to the differences in home insurance costs. Urban areas with higher rates of theft or vandalism may see steeper premiums. Insurance companies need to cover the higher chance of claims in these places. In contrast, rural areas may have lower crime rates but face higher risks from other factors, such as wildfires or limited access to emergency services. All these factors work together to create a patchwork of insurance rates across the nation.

Key Factors That Affect Home Insurance Premiums

One major factor that affects home insurance premiums is the value and age of the home. Older homes may face higher premiums because they often need more repairs and may not meet current safety codes. Expensive homes also cost more to rebuild or repair, so insurers charge more to cover them. Even the materials used in a house can influence the price. For example, homes with wooden roofs are more expensive to insure due to the increased fire risk.

A credit score is another factor that insurance companies use to determine rates. Homeowners with higher credit scores often pay less for coverage. Insurance providers see a good credit score as a sign of financial responsibility and lower risk. On the other hand, people with lower credit scores may pay more, even if they live in a low-risk area. Some states limit the extent to which credit scores can affect insurance prices, but most still permit it as a factor.

Claims history also has a significant impact on what homeowners pay for insurance. Individuals who have filed multiple claims in the past may experience an increase in their rates. Insurers view a pattern of claims as a sign that more claims may occur in the future. Even claims that were not the homeowner’s fault can affect premiums. For many, taking steps to avoid claims can help keep costs down over time.

The Impact of Weather and Natural Disasters on Costs

Extreme weather and natural disasters have a significant effect on home insurance rates. Areas that are often affected by hurricanes, tornadoes, wildfires, or floods typically have much higher premiums. Insurance companies set rates by considering the risks associated with living in these areas. When a region faces repeated storms or disasters, insurance costs tend to rise for everyone, even those who have not filed a claim.

Climate change has also made weather patterns less predictable and more intense. More frequent and severe storms mean insurers must pay out more for damage. To cover these rising costs, companies raise premiums in affected areas. Homeowners in coastal regions or areas prone to wildfires have seen some of the most significant increases in recent years. This trend is expected to continue as weather events become more extreme.

Some areas may require additional insurance, such as flood or earthquake coverage, which can increase overall costs even further. A standard home insurance policy might not cover all types of damage in risky locations. Homeowners often need to purchase additional policies, which increase their total insurance expenses. Those living in less disaster-prone areas typically pay less overall; however, no region is entirely immune to risk.

Where Homeowners Face the Highest Insurance Rates

Certain parts of the United States are known for having the highest home insurance rates. According to Florida Insurance Quotes, states like Florida, Louisiana, and Texas usually top the list. These states frequently experience hurricanes, flooding, and other disasters that increase costs. Homeowners in these regions often pay thousands of dollars more each year than those in safer areas. Even within these states, coastal regions frequently have the highest rates.

Florida stands out for its high premiums due to the constant risk of hurricanes and intense storms. The state’s location makes it a regular target for hurricanes, which cause widespread damage. Insurers pass these high risks on to customers through steep premiums. Louisiana and Texas also face similar challenges from hurricanes and flooding, placing them near the top in terms of insurance costs.

Other states with high rates include Oklahoma and Kansas, where tornadoes are common threats. In California, earthquake and wildfire risks drive up insurance prices, especially in certain counties. Urban areas with high rebuilding costs, such as New York City, can also have expensive premiums. Regardless of where a person lives, understanding local risks is crucial for preparing for potential higher insurance expenses.

What Homeowners Can Do to Manage Their Insurance Costs

Homeowners do not have to accept high insurance costs without exploring ways to reduce them. One of the best steps is to shop around and compare offers from several insurance companies. Rates and coverage can vary significantly between providers, even within the same area. Raising the deductible can also lower monthly premiums, just be sure to have enough savings to cover it if needed. Bundling home and auto insurance with the same company can also lead to discounts.

Making a home safer and more resistant to damage can also help reduce insurance costs. Adding security systems, smoke detectors, and storm shutters makes a house less risky for insurers. Upgrading roofs or windows to meet new safety standards may also earn discounts. Regular maintenance to prevent water leaks, fire hazards, or other damage can keep claims down and rates stable. Some insurance companies offer lower rates for homes near fire stations or with sprinkler systems.

Homeowners should review their insurance policy annually. As home values and risks change, updating coverage can prevent overpaying for insurance. Inquiring with an agent about potential discounts or new programs can reveal hidden savings. Staying claim-free, maintaining good credit, and being proactive about safety all help keep costs under control. With careful planning, homeowners can manage their insurance expenses, even in high-risk regions.

Conclusion

Home insurance costs vary widely across the United States for many reasons. Local risks, weather patterns, building codes, and even credit scores all shape what homeowners pay to protect their property. Some states face enormous challenges from hurricanes, floods, wildfires, or tornadoes, which push premiums to the highest levels. Florida, Louisiana, Texas, and parts of California and Oklahoma consistently report the highest home insurance rates in the country. People living in these areas need to plan for higher costs and consider extra coverage for unique local threats. However, all homeowners have options to manage their expenses. Shopping around, improving home safety, and understanding the details of a policy can make a big difference. Staying informed about local risks and changes in the insurance market is also essential. By taking these steps, homeowners can protect their property without overspending. No matter where a person lives, a little effort and knowledge go a long way in finding the right balance between cost and coverage. Home insurance will always be a necessary expense, but wise choices can make it more affordable and practical for families across the country.